Introduction

Corporate culture can define the success—or failure—of any business. It shapes how employees interact, influences decisions, and reflects a company’s values to the world. When that culture harbors secrecy, discrimination, or tolerance of misconduct, it can lead to devastating consequences for individuals and organizations alike.

Recent controversies surrounding Fox have brought its corporate culture into sharp focus, particularly regarding its history of sexual harassment. Today, we will explore the disconnect between Fox’s public image and the internal culture that has led to repeated high-profile cases of misconduct.

For those who have endured workplace harassment, this serves as a reminder that accountability, transparency, and reform are not just ideals but necessities. If you’ve experienced similar issues in your workplace, remember—no company is above the law.

Defining Corporate Culture

Corporate culture refers to the shared values, norms, and practices that guide how employees interact and collaborate within an organization. It’s embedded in everything from leadership style to workplace policies. A healthy corporate culture fosters respect, creativity, and accountability. On the other hand, a toxic culture breeds fear, misconduct, and complacency.

At its core, corporate culture isn’t just about glossy mission statements or the perks offered to staff. It’s about real, day-to-day experiences that shape employees’ perceptions of their workplace—a truth that Fox’s controversies bring into sharp relief.

The Image Fox Projects

Fox has long portrayed itself as a trailblazing media empire to the outside world. With its internal spotlight awards and a global reputation, the company has attracted top-tier talent and created opportunities in the entertainment and media worlds.

Internally, Fox promises a dynamic, inclusive, and fiercely competitive environment. For prospective employees, it pitches itself as an employer of choice—an arena where innovation and hard work are richly rewarded.

However, as we explore more deeply, the surface-level promises of such corporate culture often clash with the troubling reality that employees, especially women, have faced behind closed doors.

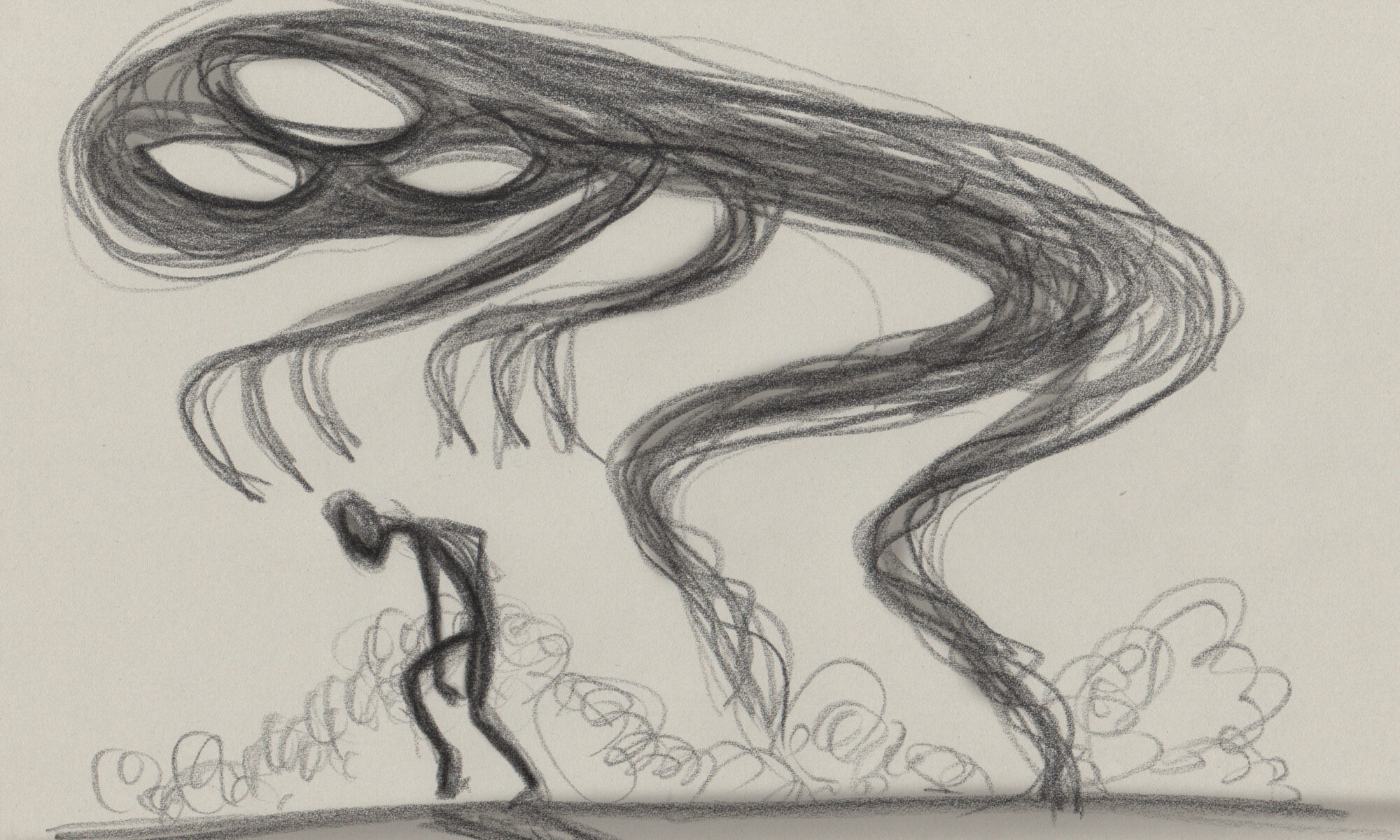

The Shadow Side of Fox’s Corporate Culture

Despite the image of success, stories from within Fox expose a corporate culture plagued by sexual harassment, discrimination, and a lack of accountability. Over the years, high-profile cases have painted a picture of unchecked power and toxic work environments.

A History of Allegations and Settlements

Below are some documented cases that highlight recurring patterns of harassment and legal action against Fox and its employees.

- Roger Ailes founded Fox News and served as its chairman and CEO. He played a significant role in shaping conservative media.

- Date Sexual Harassment Lawsuit Filed: July 6, 2016

- Award: Gretchen Carlson received a $20 million settlement after accusing then-CEO Roger Ailes of sexual harassment. This case became a turning point, exposing a long-standing culture of abuse within the organization.

- Bill O’Reilly was a prominent figure at Fox News, where he hosted the news commentary program The O’Reilly Factor from 1996 until 2017. For many years, The O’Reilly Factor was one of the highest-rated cable news shows, making O’Reilly a significant influence in conservative media.

- Date Sexual Harassment Lawsuit Filed: Settlements came to light in 2017

- Award: Over $45 million were paid across multiple settlements after allegations surfaced against the former prime-time anchor.

- Jamie Horowitz was a prominent executive at Fox Sports, serving as National Networks’s President. He oversaw programming and digital news operations for Fox Sports, including channels FS1 and FS22. Horowitz was known for shifting the focus of Fox Sports programming towards talk personalities and away from traditional newsgathering.

- Date Sexual Harassment Lawsuit Filed: July 2017

- Award: Settlement details remain undisclosed, but allegations of sexual misconduct led to his departure from the network.

- Charles Payne is a Fox Business Network (FBN) financial journalist and television personality. He joined Fox News Media as a contributor in 2007 and currently hosts the show “Making Money with Charles Payne.”

- Date Sexual Harassment Lawsuit Filed: July 2017

- Award: Like Horowitz, Payne’s settlement details were not disclosed, though harassment allegations resulted in widespread internal criticism.

- Skip Bayless was a prominent sports commentator at Fox Sports, where he co-hosted the show “Skip and Shannon: Undisputed” on Fox Sports 1 (FS1) from September 2016 until August 2024.

- Date Sexual Harassment Lawsuit Filed: January 6, 2025 (ongoing) The suit alleges Bayless offered the plaintiff $1.5 million to have sex with him and that an FS1 exec grabbed her buttocks at a party.

- Award: Still pending, this lawsuit further illustrates the cycle of accusations that continues to haunt Fox’s legacy.

- Charlie Dixon is the Executive Vice President of Content at Fox Sports 1 (FS1). He joined Fox Sports in July 2015 and oversees all content and production on the channel.

- Date Sexual Harassment Lawsuit Filed: January 6, 2025 (ongoing) The lawsuit accuses Dixon of grabbing her buttocks at a bar and elevating Joy Taylor thanks to their relationship; the complaint accuses Fox of ignoring multiple complaints she lodged with HR over the years.

- Award: Still pending, this lawsuit further illustrates the cycle of accusations that continues to haunt Fox’s legacy.

Over the years, these cases reveal a disturbing pattern of allegations, payouts, and secrecy—paving the way for a permissive environment where harassers faced little accountability.

Impact on Employees

Behind these legal battles lie real human costs. Employees who remain at Fox following incidents of harassment often report feeling unheard, unprotected, and demoralized.

Victims of harassment face stigmas that damage their confidence, health, and professional growth. For many women at Fox, silence seemed like the only option to maintain their careers. Those who spoke out, like Gretchen Carlson, risked not only their jobs but also their reputations.

This culture of fear and inaction harms more than individual employees—it weakens teams, stifles creativity, and erodes trust throughout the organization.

Fox’s Response and Reforms

To its credit, Fox has acknowledged some of its corporate failings and introduced measures aimed at fixing them. These include launching anonymous reporting tools, hiring external consultants to assess workplace culture, and holding leadership training addressing harassment.

But critics argue these reforms fall short of addressing the root causes of issues at Fox. Real accountability requires transparent communication, thorough investigations, and public disclosures about how the company handles such complaints. It’s a long road from acknowledging problems to truly shifting an entrenched corporate mindset.

Lessons for the Future

The challenges faced by Fox aren’t unique. Companies across industries must consider the long-term harm caused by toxic workplace cultures. However, Fox’s story provides a stark lesson for leaders in any organization:

- A company’s corporate culture must align with its public image. Misalignment breeds distrust and risks credibility.

- Harassment stems not simply from individual bad actors but from systems that enable their behavior.

- Accountability and timely action are critical in fostering a safe and effective workplace.

For Fox, the future depends on its ability to address these issues openly. Without significant shifts, its culture risks dragging the larger organization into further controversies.

Final Thoughts

The Fox revelations serve as both a wake-up call and a rallying cry for broader workplace accountability. Sexual harassment isn’t just an HR issue—it’s a systemic failure that hampers businesses’ ability to thrive.

If you or someone you know has faced harassment at the workplace, know that there are paths to take. Contact an experienced employment attorney and hold corporations accountable for creating safe and fair work environments. Speaking up about harassment isn’t just about personal justice—it’s about ensuring that nobody else has to endure the same abuse.

Corporate culture reflects leadership and values in action. The question remains—how will organizations like Fox use this opportunity to redefine theirs?

Like this:

Like Loading...