Wage Suppression in the Tech Industry: A Hidden Injustice

In the heart of Silicon Valley, a narrative of innovation and meritocracy often masks a more complex reality. For years, whispers of wage suppression and citizenship-status discrimination have circulated, but a recent lawsuit against Tesla has cast a harsh spotlight on these allegations. This isn’t just about one company; it’s about a systemic issue that impacts thousands of U.S. workers and exploits foreign talent. The practice of favoring H-1B visa holders to cut labor costs raises serious questions about fairness, legality, and the very integrity of the tech industry’s hiring practices.

This article examines the growing problem of wage suppression and wage theft in the tech sector. We will explore the mechanisms behind it, using the Tesla lawsuit and other corporate examples as case studies. By understanding the legal and economic implications, we can see the full picture of how these practices harm both American and immigrant workers and what can be done to fight back.

The H-1B Visa Program: Intent vs. Reality

The H-1B visa program was designed to allow U.S. companies to temporarily employ foreign workers in specialty occupations. Supporters argue it is essential for accessing a global pool of skilled talent, filling critical shortages, and driving innovation that fuels economic growth. The intention was to supplement the domestic workforce, not replace it.

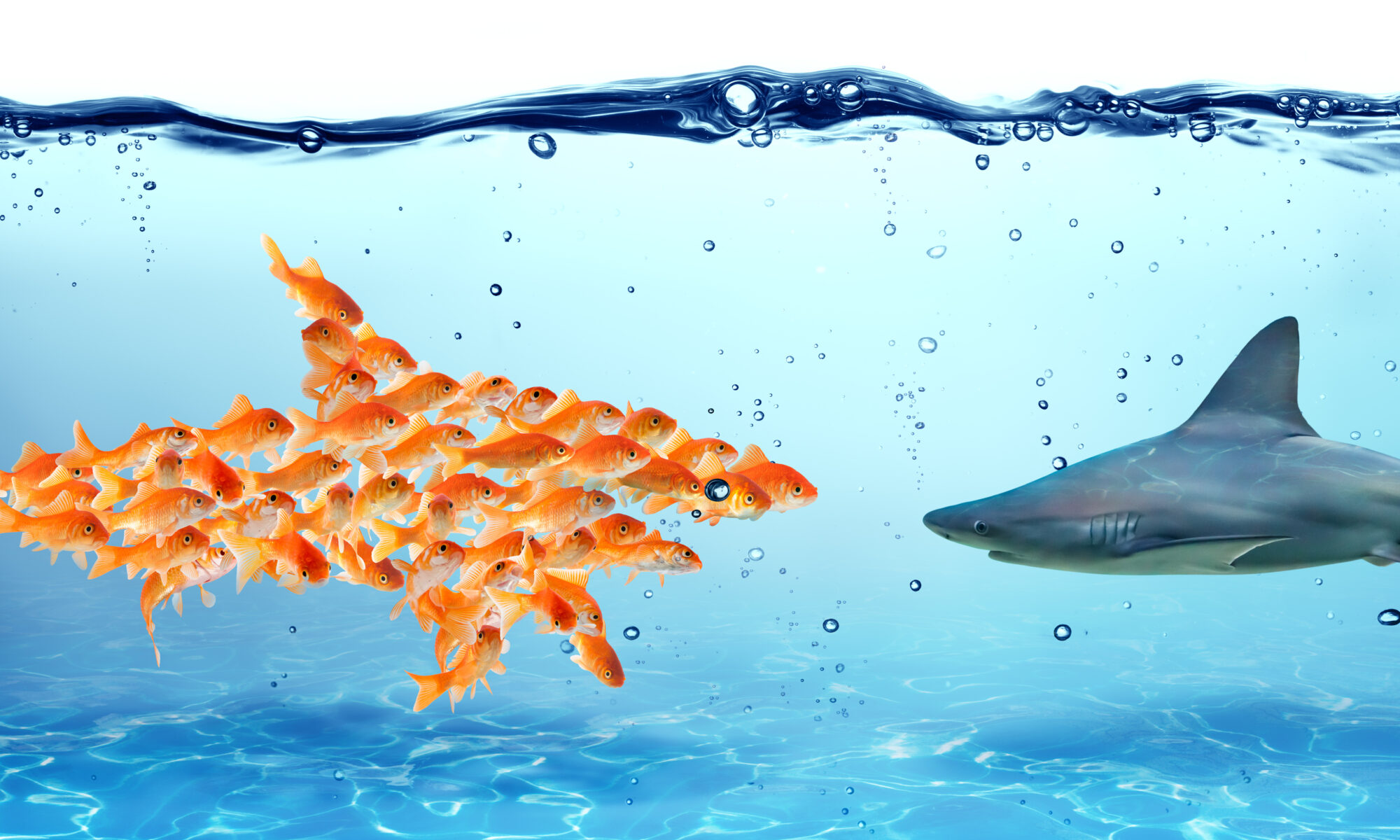

However, critics argue that the system is being manipulated. Some firms allegedly exploit the program to drive down labor costs. They achieve this by heavily recruiting from visa-dependent channels and sidelining qualified U.S. applicants, particularly mid-career professionals who command higher salaries. This creates an environment where H-1B workers, often tied to their employer for their immigration status, may be paid less than their American counterparts for the same job. This practice, a form of wage suppression, not only harms the visa holders but also depresses salary standards for all employees in a team or company, amounting to what some plaintiffs call wage theft.

A Pattern of Discrimination: Tesla, Disney, and Beyond

The allegations against major corporations reveal a disturbing trend of using the H-1B visa system to undercut American workers and exploit foreign ones.

Case Study: The Tesla Lawsuit

A lawsuit filed against Tesla alleges the company engages in a systematic pattern of discrimination based on citizenship status. The complaint claims Tesla favors H-1B visa holders over U.S. citizens in hiring, promotions, and even during layoffs, all in an effort to reduce labor costs.

According to the lawsuit, Tesla hired approximately 1,355 H-1B workers in 2024 while simultaneously laying off over 6,000 employees, the majority of whom are believed to be U.S. citizens. Plaintiffs argue this demonstrates a clear hiring bias and a pattern of protecting lower-paid visa holders during workforce reductions. The case, which seeks class-action status, alleges violations of federal civil rights laws that protect against national origin discrimination and citizenship-status discrimination. While Tesla has yet to respond in court, the case could have significant ripple effects across the industry.

Other Notable Examples

The problem extends far beyond Tesla. Companies like Disney, FedEx, and Google have also been implicated in practices that degrade labor standards through the use of subcontracted H-1B visa holders. IT staffing firms, such as HCL Technologies, have been accused of exploiting visa holders by paying them less than their U.S. counterparts, a direct violation of H-1B statutes. One report suggests this illegal practice has led to underpayments of at least $95 million, affecting thousands of migrant workers.

This exploitation creates a two-tiered system. U.S. workers face depressed wages and are often replaced by lower-paid H-1B employees, while the visa holders themselves are trapped in a cycle of underpayment and dependency.

The Legal and Economic Fallout

Proving systemic discrimination is a difficult legal battle. According to legal experts, plaintiffs will need to produce extensive evidence, including detailed hiring and pay records, internal communications, and statistical analyses showing a clear pattern of bias. If successful, the consequences for companies like Tesla could be severe, including financial penalties, back pay orders, and court-mandated changes to hiring and recruitment processes. This could force a broad re-evaluation of how tech companies use “sponsorship-preferred” filters and recruit talent.

The economic impact on U.S. workers is significant. When companies systematically hire lower-paid visa holders, it artificially lowers the market rate for skilled labor. This wage suppression makes it harder for American workers to negotiate fair salaries and can lead to long-term career stagnation and financial hardship.

Holding Power Accountable

The exploitation of the H-1B system has been enabled, in part, by a lack of vigorous enforcement. Government agencies like the Department of Labor (DOL) have been criticized for failing to adequately enforce wage rules and close loopholes that allow for outsourcing and underpayment.

Workers who believe they have been victims of citizenship-status discrimination can file complaints with the Department of Justice’s Immigrant and Employee Rights Section (IER). This agency is responsible for enforcing laws against unfair hiring and firing based on citizenship or immigration status. It is crucial for agencies like the DOL, the Department of Homeland Security (DHS), and the Department of Justice (DOJ) to take decisive action. This includes launching investigations, imposing significant penalties on offending companies, and closing the legal gaps that allow this exploitation to continue.

It’s Time to Fight for Fair Labor Practices

The allegations of wage suppression and pay discrimination in the tech industry are not just isolated incidents; they are symptoms of a systemic problem that undermines fair labor practices for everyone. Companies that exploit visa programs to cut costs are not only breaking the law but are also betraying the trust of their employees and the public. It is a form of wage theft that harms both the immigrant workers who are underpaid and the U.S. workers who are sidelined.

If you are a worker who has been denied a job, paid unfairly, or laid off due to what you believe is national origin discrimination or citizenship-status discrimination, you have rights. Speaking with an experienced employment law attorney can help you understand your options and hold these companies accountable. You are not alone, and help is available.

At Helmer Friedman LLP, we are committed to fighting for justice for workers who have been wronged. If you have faced wage theft or citizenship-status discrimination, or if you have information about the misuse of visa programs, contact us for a free, confidential case evaluation.