Case Against Publix Super Markets

When Publix Super Markets gained attention recently, it wasn’t for the quality of its groceries or customer service. Instead, the company has been accused of defrauding its own customers through manipulative checkout practices. This case, centered on allegations of fraudulently inflating the weights of food items advertised at discounted prices, highlights the critical importance of class action lawsuits in protecting consumers and holding corporations accountable.

The Allegations Against Publix Super Markets

The lawsuit against Publix Super Markets was filed in the US District Court for the Southern District of Florida by a group of plaintiffs who claim they were overcharged at checkout due to deceptive pricing practices. The complaint alleges that Publix consistently and systematically misweighed its products, such as deli meats, seafood, and produce, resulting in customers paying more than the advertised price.

Understanding Class Action Lawsuits

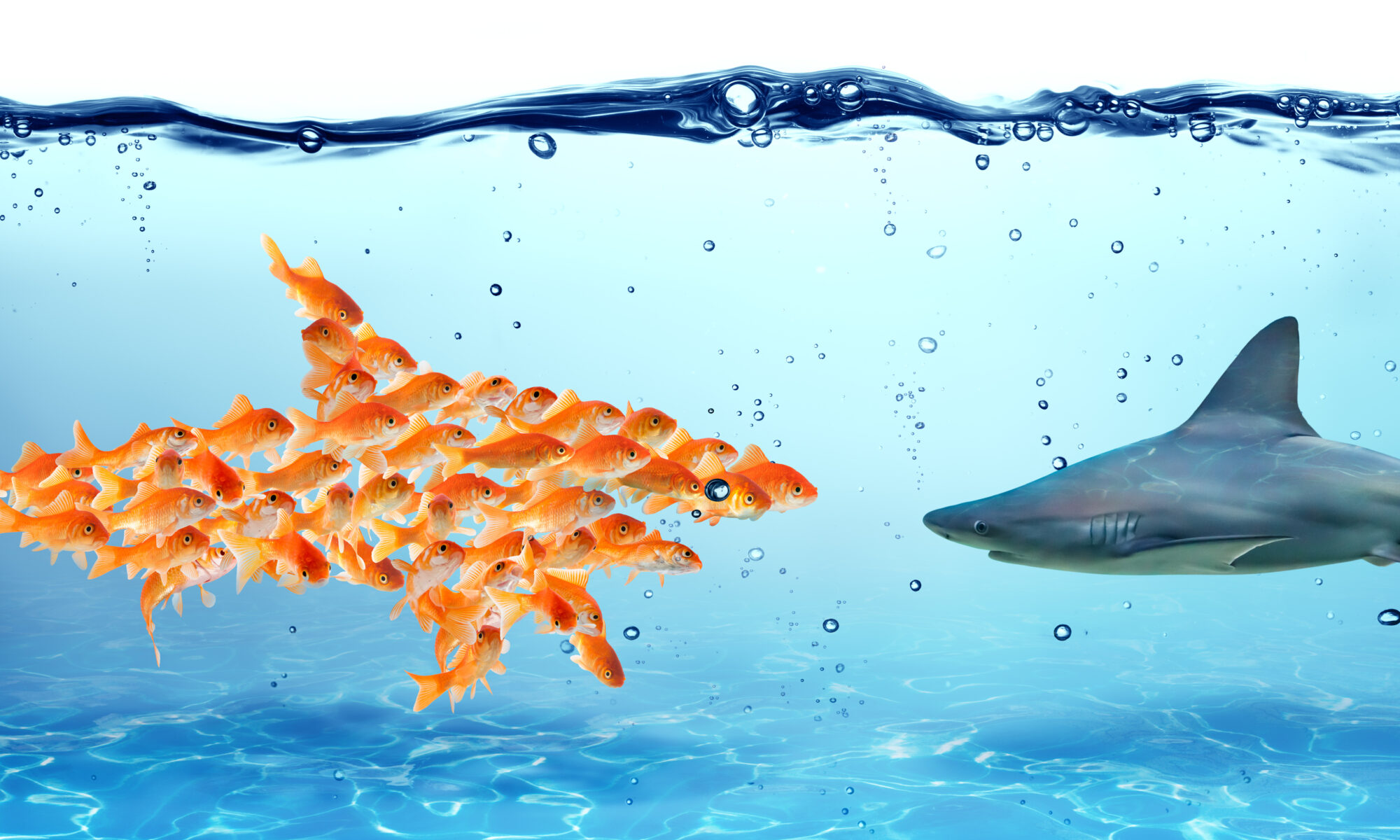

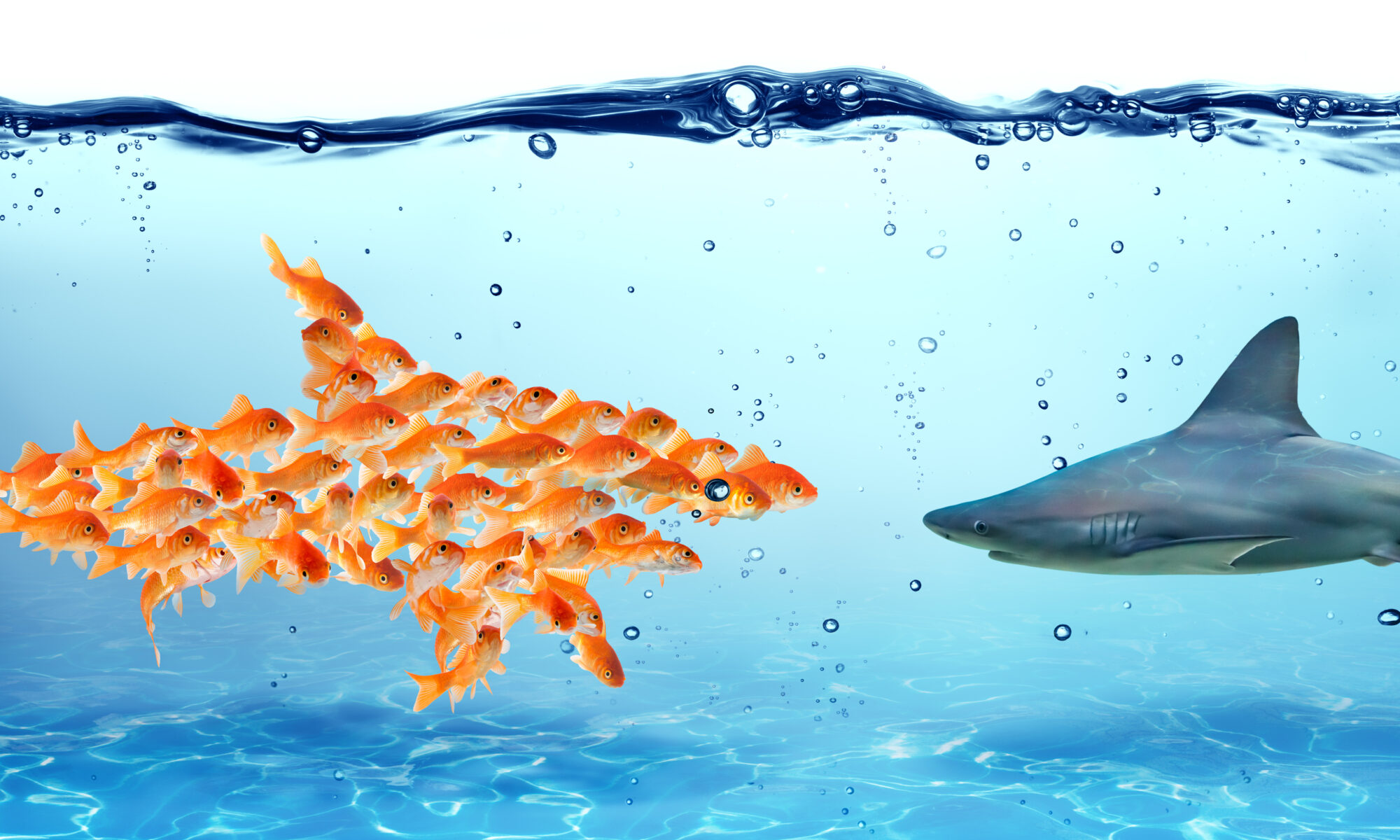

Class action lawsuits are lawsuits brought on behalf of a large group of people who have suffered similar harm or damages. These individuals may not have been able to bring a case on their own due to limited resources or because their individual claims may not hold much weight against a powerful corporation.

According to the 47-page lawsuit filed in Florida, Publix is accused of falsely inflating the weights of foods sold by weight, including meats, cheeses, and deli items, at the point of sale. The lawsuit alleges that when customers purchase discounted items, Publix’s point-of-sale (POS) system automatically increases the product’s weight, ensuring customers are charged the original, non-sale price.

For example, the plaintiff purchased pork tenderloin advertised at $4.99 per pound with a savings of $2.00 from the original $6.99 per pound price. The product label indicated it weighed 2.83 pounds, which should have cost $14.12. However, the point-of-sale system allegedly increased the weight to 3.96 pounds, ultimately charging the plaintiff $19.78 – a 40% overcharge.

Making matters worse, Publix’s receipts reportedly omit weight details, leaving customers unaware of these discrepancies. This lack of transparency, combined with employees allegedly being incentivized to conceal the practice and dismiss customer complaints, paints a troubling picture of deliberate consumer exploitation.

The Broader Implications for Consumers

This case goes beyond a single instance of overcharges; it reveals fundamental issues in consumer protection and the accountability of large businesses. Here’s why this lawsuit matters to consumers:

- Direct Financial Loss

Every dollar matters, especially as grocery prices continue to rise. Publix’s alleged overcharges mean customers are robbed of promised savings and forced to pay more than they bargained for. Multiply this practice across the company’s 1,439 locations, and the financial impact on consumers is staggering.

- Deceptive Practices

At its core, the lawsuit raises serious concerns about dishonesty in business. Deceptive practices like inflating weights and misrepresenting discounts undermine consumer trust—not just in one company but in the broader retail industry.

- Holding Corporations Accountable

Without mechanisms like class action lawsuits, large corporations could engage in deceptive practices with little fear of repercussions. An individual filing a lawsuit against a conglomerate might lack the resources to make a meaningful impact. However, collective action enables consumers to pool resources and challenge misconduct effectively, leveling the playing field.

- Empowering Consumer Awareness

Cases like this shine a light on unethical corporate behavior and encourage consumers to scrutinize their purchases. By reviewing receipts and questioning discrepancies, shoppers can better protect themselves against potential fraud.

- Setting Legal Precedents

The outcome of this lawsuit could establish important legal precedents. Should Publix be found liable, it could lead to stricter regulations preventing similar behavior across the retail industry, ensuring better protections for consumers everywhere.

The Power of Class Action Lawsuits

Class action lawsuits like the one against Publix demonstrate their immense value to society. Individually, it may be impractical to sue a major corporation over a relatively small financial loss. However, when consumers unite, they create a powerful force for justice.

Historical cases underscore the significance of these legal actions:

- Volkswagen’s $14 Billion Settlement for emissions fraud punished the automaker for deceptive environmental practices.

- The Tobacco Master Settlement Agreement imposed crucial regulations on tobacco companies, advancing public health initiatives.

- Enron Securities Litigation recovered billions for defrauded shareholders, providing financial relief and setting an example for corporate accountability.

These cases remind us that class actions aren’t just about financial compensation; they’re about ensuring that corporations prioritize ethical practices and consumer trust over profits.

The Role of Consumers Moving Forward

The allegations against Publix serve as a timely reminder for consumers to stay vigilant. Here’s how you can protect yourself:

- Review Receipts Thoroughly

Check for discrepancies in pricing and weights, especially for products sold by weight.

- Ask Questions

If something doesn’t seem right, inquire with store employees. Request a breakdown of charges if necessary.

- Stay Educated

Follow consumer protection news to stay informed about pressing issues and ongoing lawsuits.

- Support Class Actions

Keep an eye on open lawsuits for which you may qualify. Joining a class action is often as simple as submitting a claim.

Justice for Consumers, Accountability for Corporations

If the allegations in the Publix case are proven, the company’s actions wouldn’t just be a breach of consumer trust; they’d reflect deliberate misconduct designed to profit at the expense of everyday shoppers. Class action lawsuits like this one are essential tools to shine a light on such unethical behavior, seek justice for those affected, and push for systemic change.

Consumers work hard for their money and deserve fair treatment from the businesses they support. The Publix lawsuit teaches us the importance of collective action in protecting those rights. Stay vigilant, informed, and ready to stand united when corporate greed threatens your wallet.

When pursuing a class action lawsuit, it’s crucial to have an attorney with a proven track record of success in collective action cases. An experienced class action attorney understands the complexities of these lawsuits and knows how to advocate effectively on behalf of a large group, ensuring the best possible outcome for everyone involved.

On November 8, 2016, the U.S. Supreme Court heard oral argument in a case Helmer Friedman LLP successfully convinced the high court to hear. The case — Lightfoot v. Fannie Mae, Cendant Mortgage Corporation case (14-1055) — concerns whether individual homeowners who have been wrongly or fraudulently foreclosed upon by Fannie Mae have the right to sue the mortgage giant in the state courts.

On November 8, 2016, the U.S. Supreme Court heard oral argument in a case Helmer Friedman LLP successfully convinced the high court to hear. The case — Lightfoot v. Fannie Mae, Cendant Mortgage Corporation case (14-1055) — concerns whether individual homeowners who have been wrongly or fraudulently foreclosed upon by Fannie Mae have the right to sue the mortgage giant in the state courts.