U.S. Supreme Court Holds That Whistleblower Suing Under Sarbanes-Oxley Act Need Not Prove Their Employer Acted With “Retaliatory Intent”

On February 8, 2024, in Murray v. UBS Securities, LLC, 2024 WL 478566 (U.S., 2024) the U.S. Supreme Court held, in a unanimous decision authored by Justice Sotomayor, that a whistleblower seeking to invoke the protections of the Sarbanes-Oxley Act need not prove that their employer acted with “retaliatory intent.” Instead, the whistleblower needs to merely show that their protected activity was a contributing factor in the employer’s unfavorable personnel action.

Before discussing the details of the case, it is important to note that Murray continues an important and surprising trend at a Supreme Court (stocked with far right-wing conservative Justices) that is generally hostile to the rights of employees and consumers – it, almost uniformly, sides with employees in retaliation cases. So, as the following list demonstrates, the Supreme Court has sided with employees in 10 out of the last 13 cases stretching back nearly 20 years:

- Murray v. UBS Securities, LLC, 2024 WL 478566 (2024)(siding with employee)

- Digital Realty Trust, Inc. v. Somers, 583 U.S. 149 (2018)(siding with employer)

- Artis v. District of Columbia, 583 U.S. 71 (2018)(siding with employee)

- Green v. Brennan, 578 U.S. 547 (2016)(siding with employee)

- Heffernan v. City of Paterson, N.J., 578 U.S. 266 (2016)(siding with employee)

- Department of Homeland Sec. v. MacLean, 574 U.S. 383 (2015)(siding with employer)

- Lane v. Franks, 573 U.S. 228 (2014)(siding with employee)

- Lawson v. FMR LLC, 571 U.S. 429 (2014)(siding with employee}

- University of Texas Southwestern Medical Center v. Nassar, 570 U.S. 338 (2013)(siding with employer)

- Thompson v. North American Stainless, LP, 562 U.S. 170 (2011)(siding with employee)

- Kasten v. Saint-Gobain Performance Plastics Corp., 563 U.S. 1 (2011)(siding with employee)

- Staub v. Proctor Hosp., 562 U.S. 411 (2011)(siding with employee)

- Crawford v. Metropolitan Government of Nashville and Davidson Cnty., Tenn., 555 U.S. 271 (2009)(siding with employee)

- Gomez-Perez v. Potter, 553 U.S. 474 (2008)(siding with employee)

- Burlington Northern and Santa Fe Ry. Co. v. White, 548 U.S. 53 (2006)(siding with employee)

In Murray, the plaintiff, Trevor Murray, was employed as a research strategist at the UBS securities firm, within the firm’s commercial mortgage-backed securities (CMBS) business. In that role, Murray was responsible for reporting on CMBS markets to current and future UBS customers. Securities and Exchange Commission (SEC) regulations required him to certify that his reports were produced independently and accurately reflected his own views. Murray alleged that, despite this requirement of independence, two leaders of the CMBS trading desk improperly pressured him to skew his reports to be more supportive of their business strategies, even instructing Murray to “clear [his] research articles with the desk” before publishing them.

Murray reported that conduct to his direct supervisor, Michael Schumacher asserting that it was “unethical” and “illegal.” Schumacher expressed sympathy for Murray’s situation but emphasized that it was “very important” that Murray not “alienate [his] internal client” (i.e., the trading desk). When Murray later informed Schumacher that the situation with the trading desk “was bad and getting worse,” as he was being left out of meetings and subjected to “constant efforts to skew [his] research,” Schumacher told him that he should just “write what the business line wanted.” Shortly after that exchange (and despite having given Murray a very strong performance review just a couple months earlier) Schumacher emailed his own supervisor and recommended that Murray “be removed from [UBS’s] head count.” Schumacher recommended in the alternative that, if the CMBS trading desk wanted him, Murray could be transferred to a desk analyst position, where he would not have SEC certification responsibilities. The trading desk declined to accept Murray as a transfer, and UBS fired him.

Murray then filed a complaint with the Department of Labor alleging that his termination violated § 1514A of Sarbanes-Oxley because he was fired in response to his internal reporting about fraud on shareholders. When the agency did not issue a final decision on his complaint within 180 days, Murray filed an action in federal court.

Murray’s claim went to trial. UBS moved for judgment as a matter of law, arguing, among other things, that Murray had “failed to produce any evidence that Schumacher possessed any sort of retaliatory animus toward him.” The District Court denied the motion.

The District Court instructed the jury that, in order to prove his § 1514A claim, Murray needed to establish four elements: (1) that he engaged in whistleblowing activity protected by Sarbanes-Oxley, (2) that UBS knew that he engaged in the protected activity, (3) that he suffered an adverse employment action (i.e., was fired), and (4) that his “protected activity was a contributing factor in the termination of his employment.” On the last element, the District Court further instructed the jury: “For a protected activity to be a contributing factor, it must have either alone or in combination with other factors tended to affect in any way UBS’s decision to terminate [his] employment.” The court explained that Murray was “not required to prove that his protected activity was the primary motivating factor in his termination, or that … UBS’s articulated reason for his termination was a pretext.” If Murray proved each of the four elements by a preponderance of the evidence, the District Court instructed, the burden would shift to UBS to “demonstrate by clear and convincing evidence that it would have terminated [Murray’s] employment even if he had not engaged in protected activity.”

During deliberations, the jury asked for clarification of the contributing-factor instruction. The court responded that the jury “should consider” whether “anyone with th[e] knowledge of [Murray’s] protected activity, because of the protected activity, affect[ed] in any way the decision to terminate [Murray’s] employment.” When the court previewed this response to the parties, UBS indicated that it “would be comfortable” with that formulation.

The jury found that Murray had established his § 1514A claim and that UBS had failed to prove, by clear and convincing evidence, that it would have fired Murray even if he had not engaged in protected activity. The jury also issued an advisory verdict on damages, recommending that Murray receive nearly $1 million.

After the trial, UBS again moved for judgment as a matter of law, which the court denied. The court then adopted the jury’s advisory verdict on damages and awarded an additional $1.769 million in attorney’s fees and costs. UBS appealed the decision, and Murray cross-appealed on the issues of back pay, reinstatement, and attorney’s fees.

The Second Circuit panel vacated the jury’s verdict and remanded for a new trial. The court identified the central question as “whether the Sarbanes-Oxley Act’s antiretaliation provision requires a whistleblower-employee to prove retaliatory intent,” and, contrary to the trial court, it concluded that the answer was yes.

On appeal, the Supreme Court reversed the finding that Sarbanes-Oxley Act’s antiretaliation provision does not require that a whistleblower-employee prove retaliatory intent on the part of his or her employer:

The Second Circuit’s opinion requiring whistleblowers to prove retaliatory intent placed that Circuit in direct conflict with the Fifth and Ninth Circuits, which had rejected any such requirement for § 1514A claims. This Court granted certiorari to resolve this disagreement.

Section 1514A’s text does not reference or include a “retaliatory intent” requirement, and the provision’s mandatory burden-shifting framework cannot be squared with such a requirement. While a whistleblower bringing a § 1514A claim must prove that his protected activity was a contributing factor in the unfavorable personnel action, he need not also prove that his employer acted with “retaliatory intent.”

The Second Circuit and UBS both rely heavily on the word “discriminate” in § 1514A to impose a “retaliatory intent” requirement on whistleblower plaintiffs. As UBS acknowledges, the Second Circuit’s holding was “expressly predicated” on the word “discriminate.” That word, however, cannot bear the weight that both the Second Circuit and UBS place on it.

Consider the statutory text: No employer subject to Sarbanes-Oxley “may discharge, demote, suspend, threaten, harass, or in any other manner discriminate against an employee in the terms and conditions of employment because of ” the employee’s protected whistleblowing activity. § 1514A(a). To start, the placement of the word “discriminate” in the section’s catchall provision suggests that it is meant to capture other adverse employment actions that are not specifically listed, drawing meaning from the terms “discharge, demote, suspend, threaten, [and] harass” rather than imbuing those terms with a new or different meaning. Here, there is no dispute that Murray was “discharge[d],” and so it is not obvious that the “or in any other manner discriminate” clause has any relevance to his claim. According to UBS, though, “discriminate” in the catchall provision relates back to and characterizes “discharge,” such that “to be actionable, discharge must be a ‘manner’ of discriminating.” Accepting this statutory construction argument “for argument’s sake,” as this Court did in Bostock v. Clayton County, 590 U. S. 644, 657 (2020), the question is whether the word “discriminate” inherently requires retaliatory intent. It does not.

An animus-like “retaliatory intent” requirement is simply absent from the definition of the word “discriminate.” When an employer treats someone worse—whether by firing them, demoting them, or imposing some other unfavorable change in the terms and conditions of employment—“because of ” the employee’s protected whistleblowing activity, the employer violates § 1514A. It does not matter whether the employer was motivated by retaliatory animus or was motivated, for example, by the belief that the employee might be happier in a position that did not have SEC reporting requirements.

Murray v. UBS Securities, LLC, 2024 WL 478566, *6-8 (U.S., 2024)(cleaned up).

Thankfully, the Supreme Court’s Murray decision will lower the arbitrarily high “retaliatory animus” hurdle that some courts have previously required employees to overcome in order to prevail on their Sarbanes-Oxley retaliation claim.

Like this:

Like Loading...

Judge Jackson, who clerked for Justice Breyer, worked as a public defender, a corporate attorney, a U.S. District Court judge, and a judge on the U.S. Court of Appeals for the District of Columbia.

Judge Jackson, who clerked for Justice Breyer, worked as a public defender, a corporate attorney, a U.S. District Court judge, and a judge on the U.S. Court of Appeals for the District of Columbia.

Justice Ketanji Brown-Jackson eloquently articulated the Court’s position, pointing out that the previous rule placed an unwarranted evidentiary burden on majority-group plaintiffs and strayed from the foundational texts and historical applications of Title VII. This decision highlights that claims of discrimination should be assessed on a level playing field, emphasizing the importance of protecting all individuals, as reinforced by the Court’s earlier ruling in Bostock v. Clayton County (2020).

Justice Ketanji Brown-Jackson eloquently articulated the Court’s position, pointing out that the previous rule placed an unwarranted evidentiary burden on majority-group plaintiffs and strayed from the foundational texts and historical applications of Title VII. This decision highlights that claims of discrimination should be assessed on a level playing field, emphasizing the importance of protecting all individuals, as reinforced by the Court’s earlier ruling in Bostock v. Clayton County (2020).

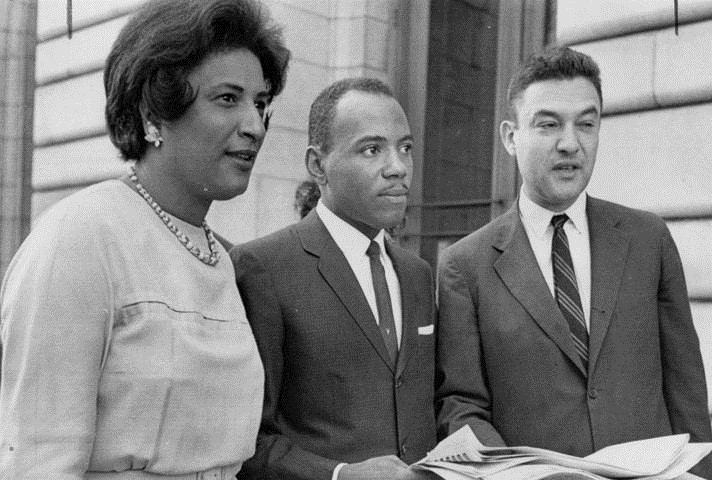

Constance Baker Motley was not only the first Black woman to argue before the Supreme Court (winning an astonishing nine of 10 cases), but she was also the first black woman to be appointed to the federal judiciary – President Lyndon B. Johnson appointed her to the Southern District of New York.

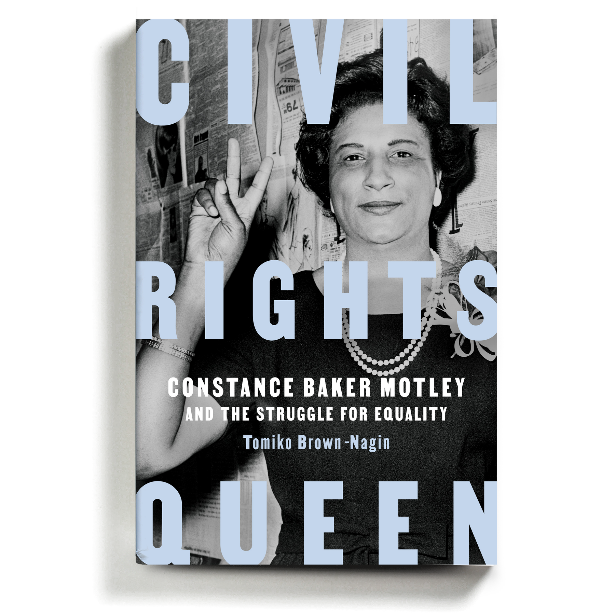

Constance Baker Motley was not only the first Black woman to argue before the Supreme Court (winning an astonishing nine of 10 cases), but she was also the first black woman to be appointed to the federal judiciary – President Lyndon B. Johnson appointed her to the Southern District of New York. In her terrific new book on Motley’s life and legacy – called “

In her terrific new book on Motley’s life and legacy – called “